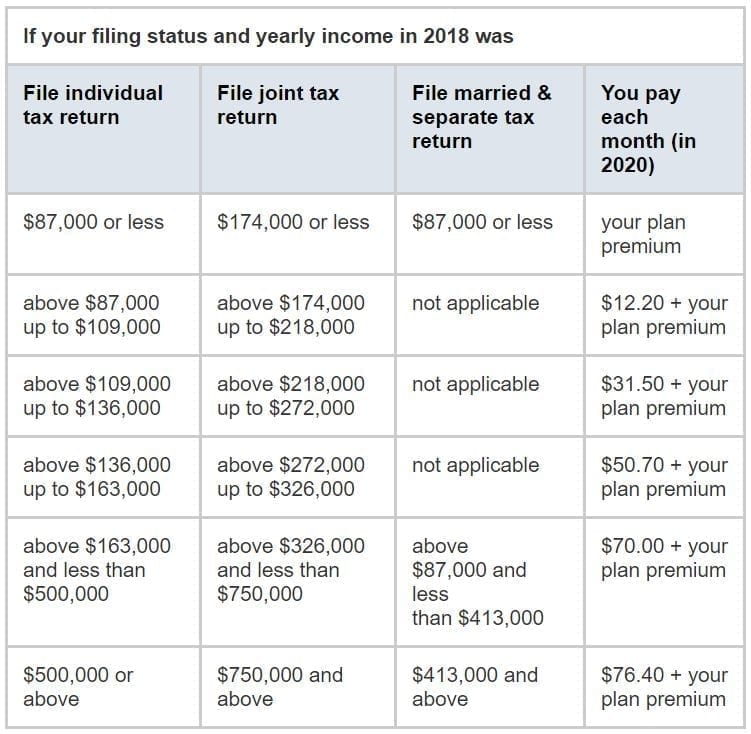

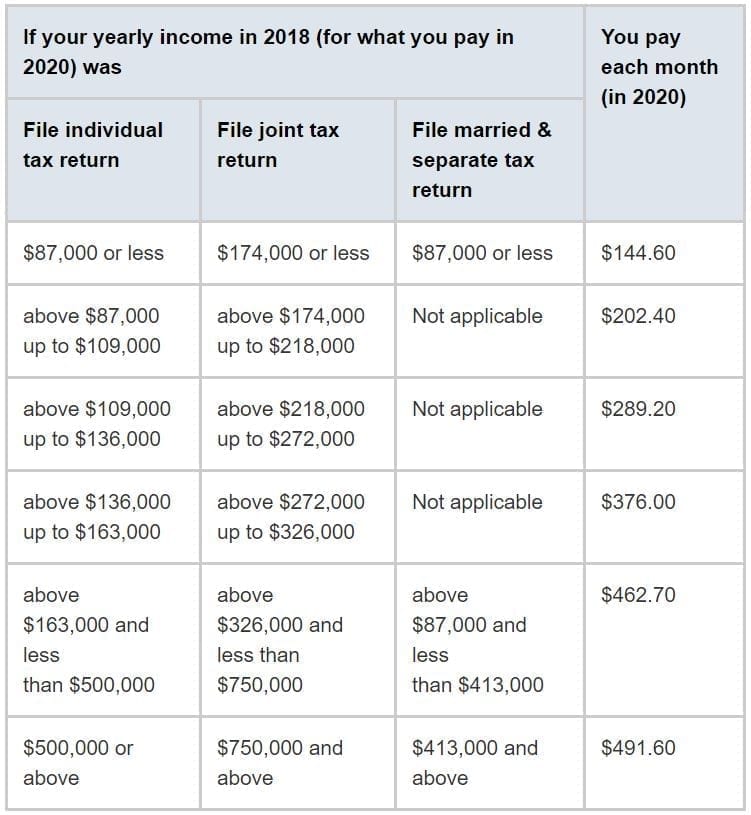

Obamacare Income Limits 2018 Chart

Use our affordable care act plan search below to automatically find premium tax credit.

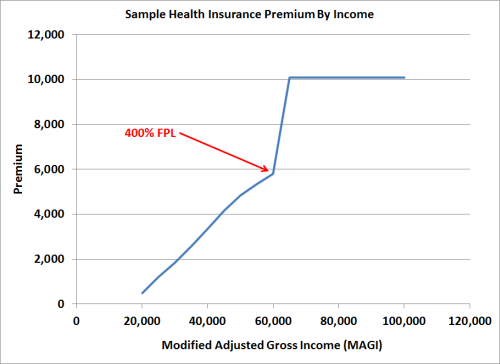

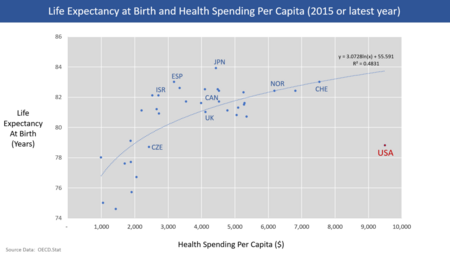

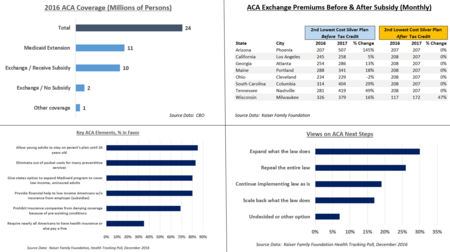

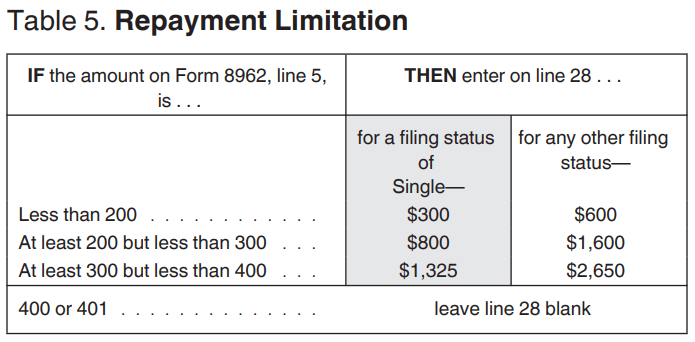

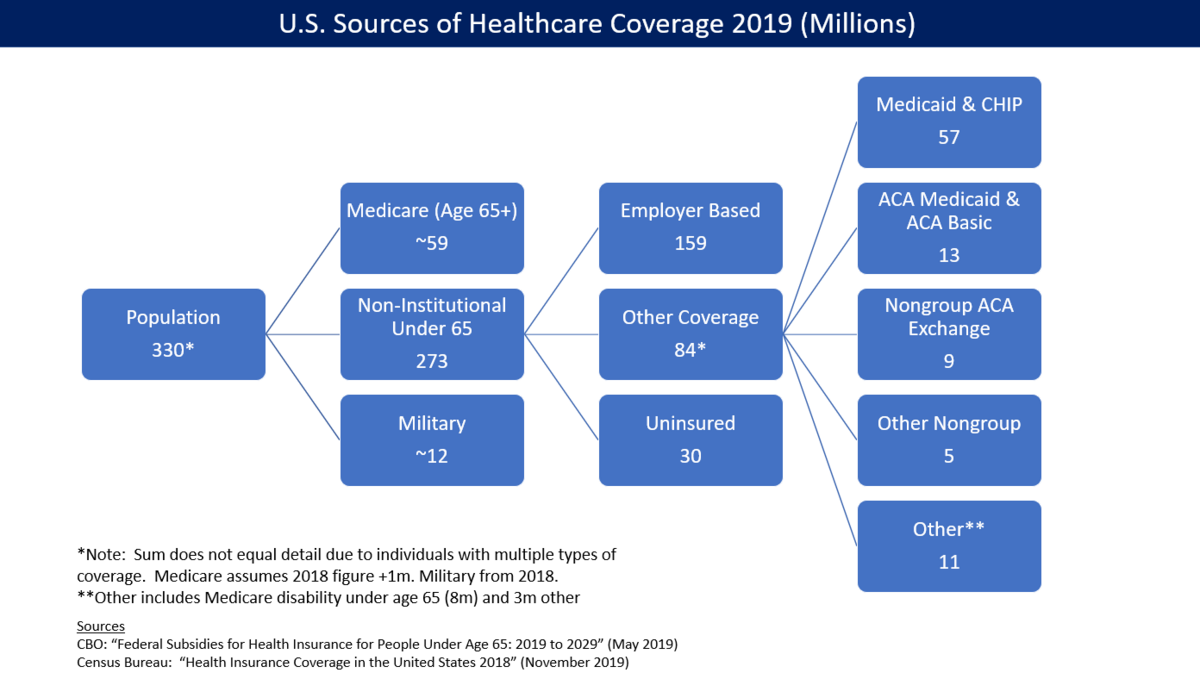

Obamacare income limits 2018 chart. My income in 2018 mostly from retirement savings will be about 24k but my obamacare health insurance premiums alone will cost nearly 17 000 and those along with other uncovered medical expenses nearly wipe out my income making me subsidy ineligible. Different families get different subsidies. The cutoff amounts for.

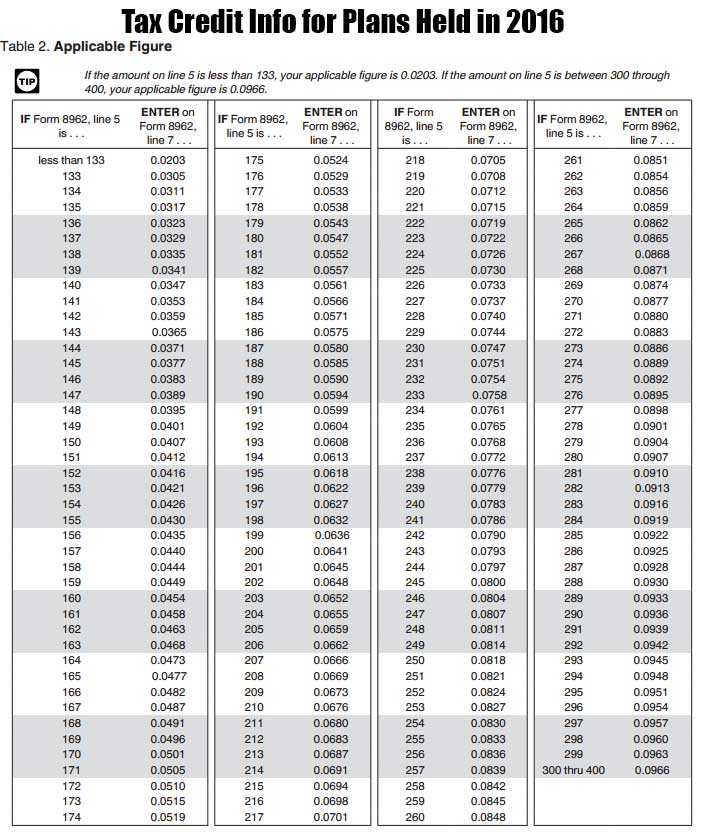

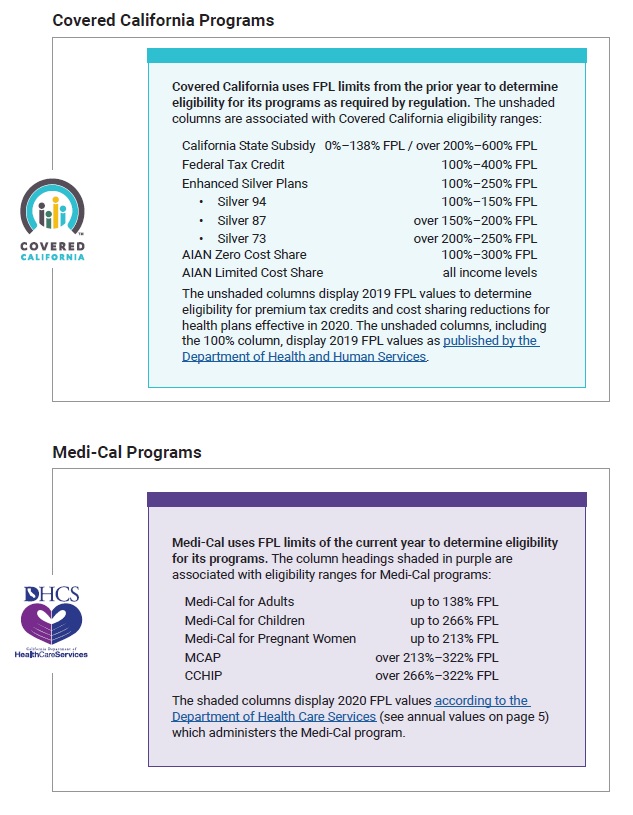

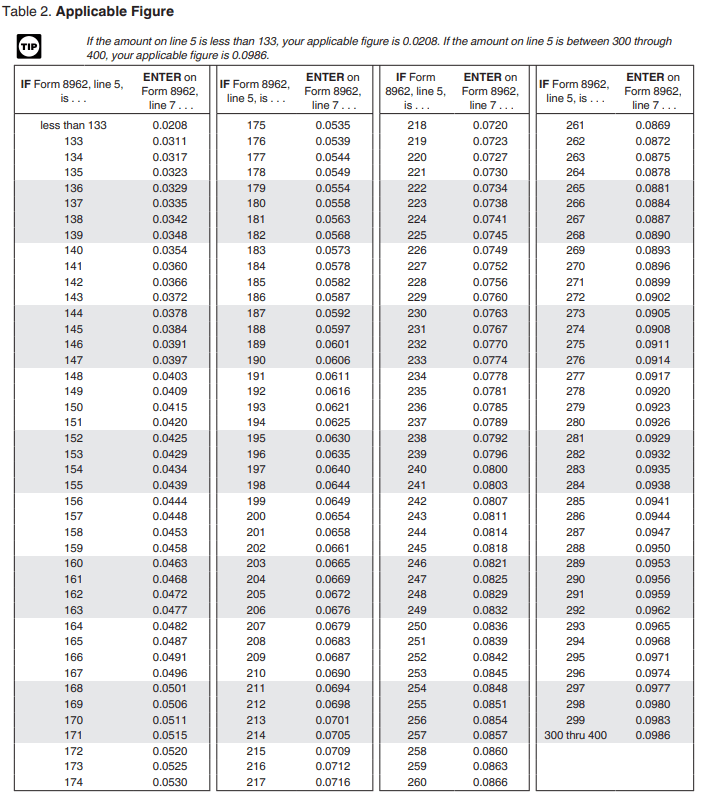

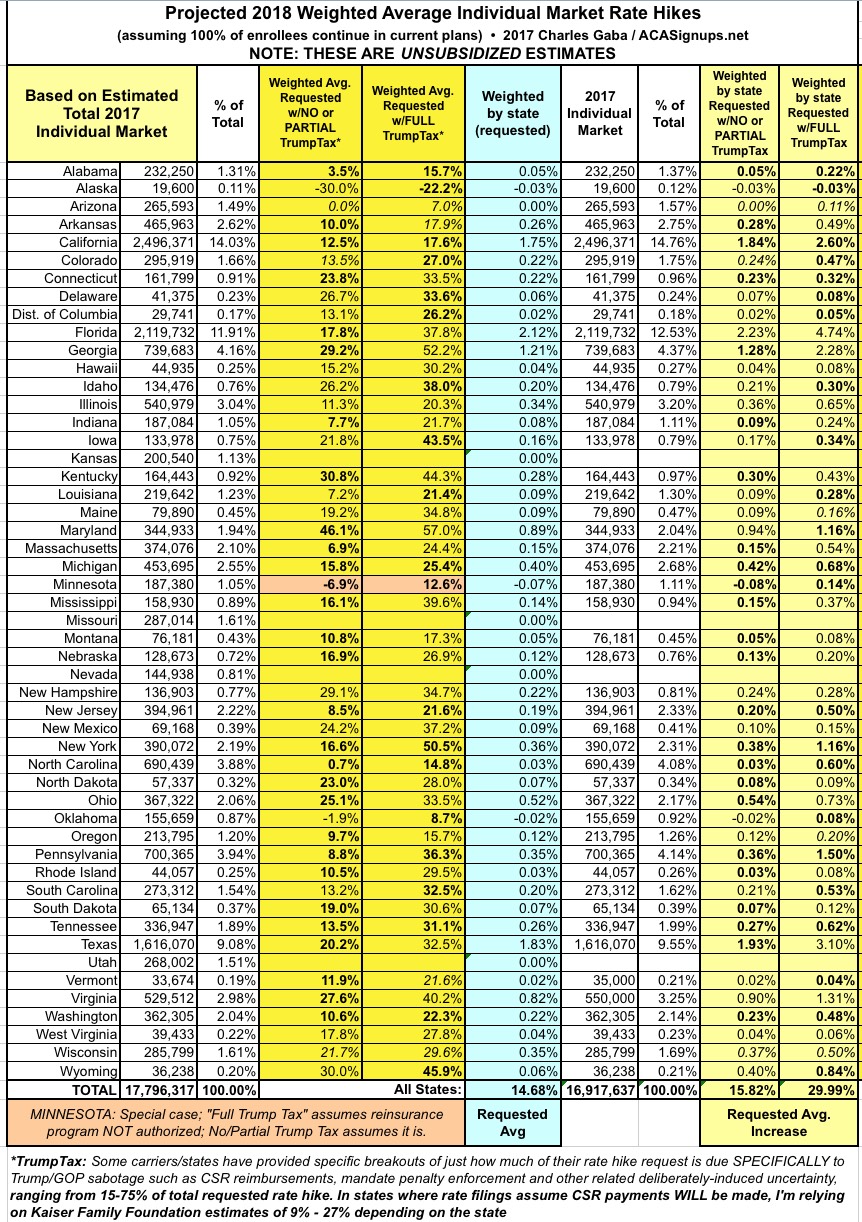

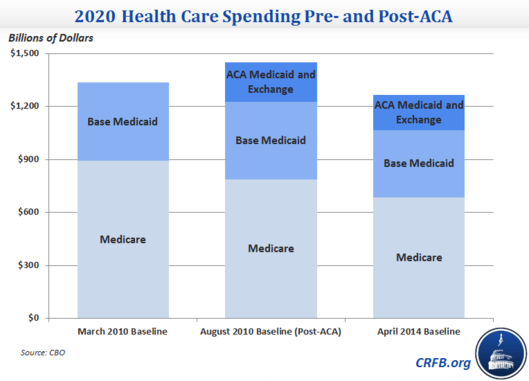

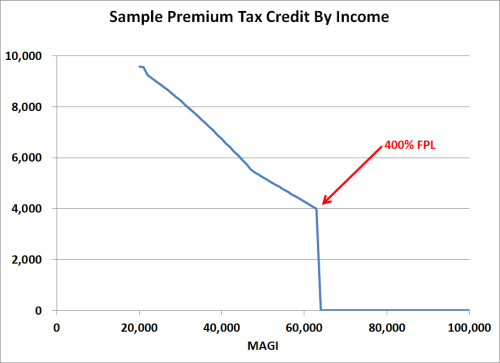

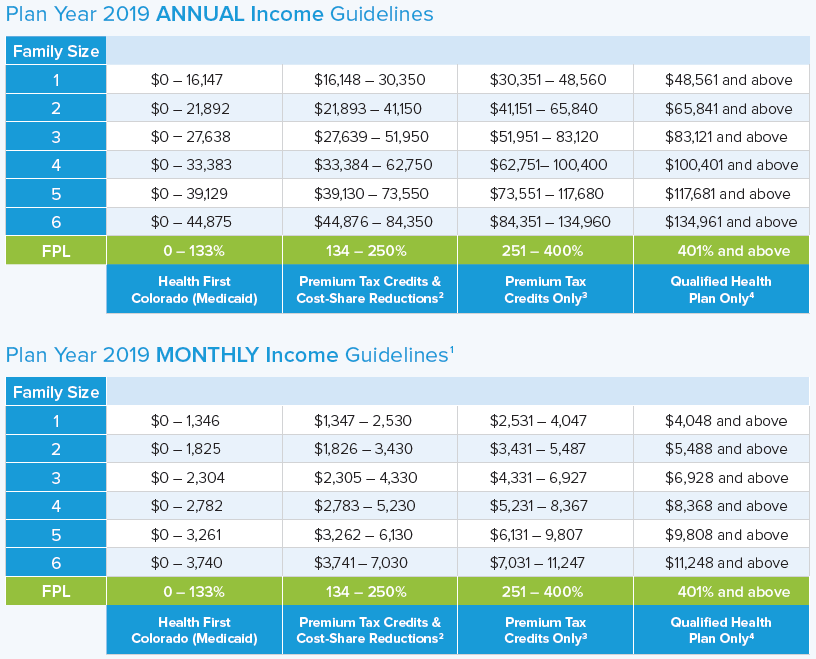

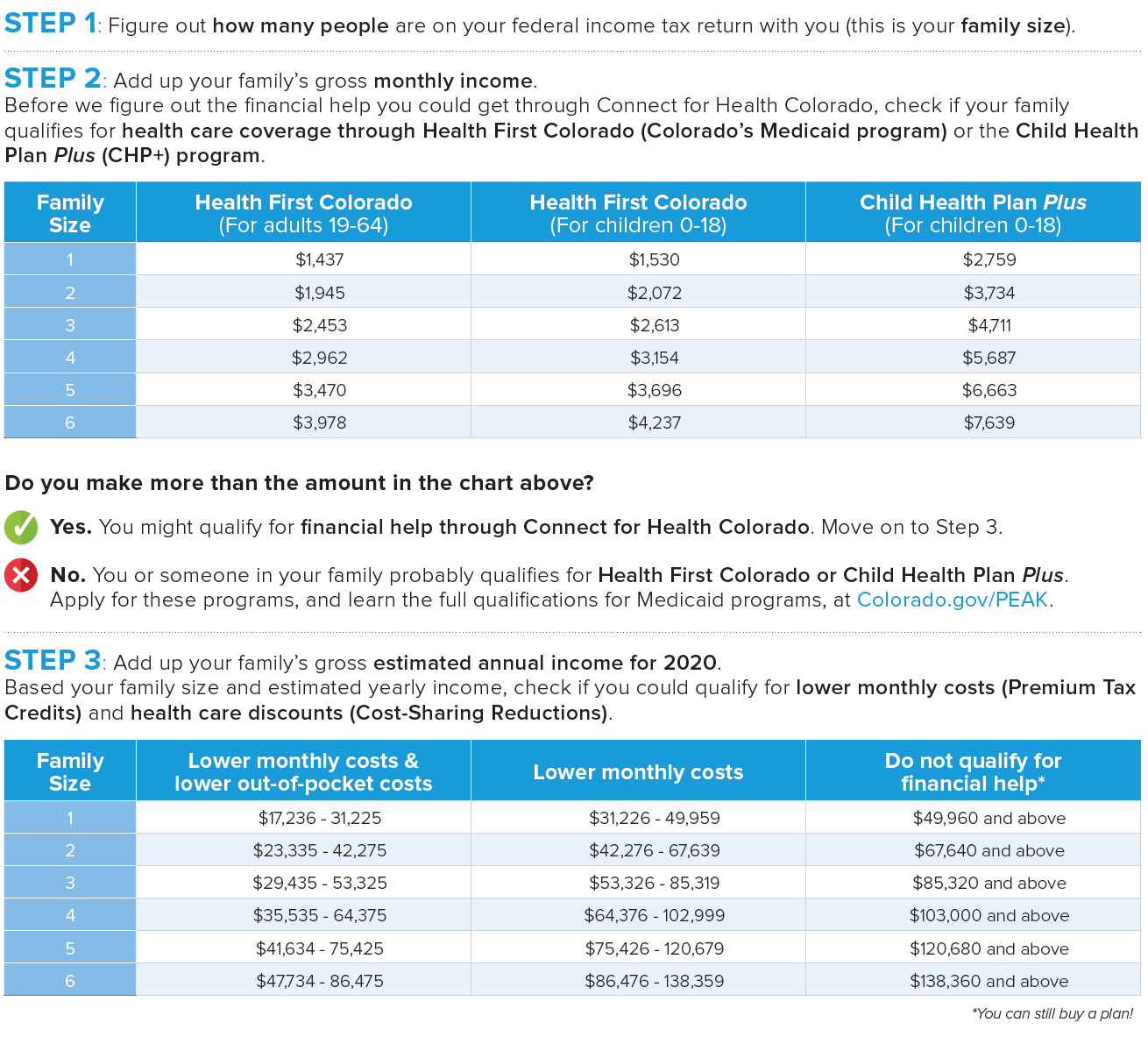

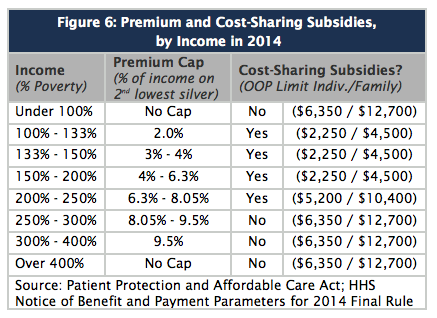

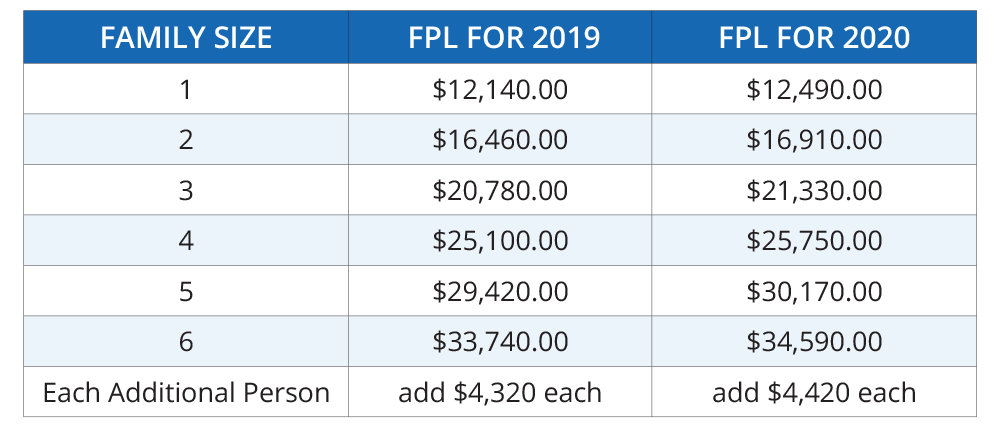

Take a look at the following chart. Maximum income for 2020 obamacare subsidies. The calculator spits out 0 subsidies which is a glitch implying such applicants pay 0 to next to nothing for annual health care premiums.

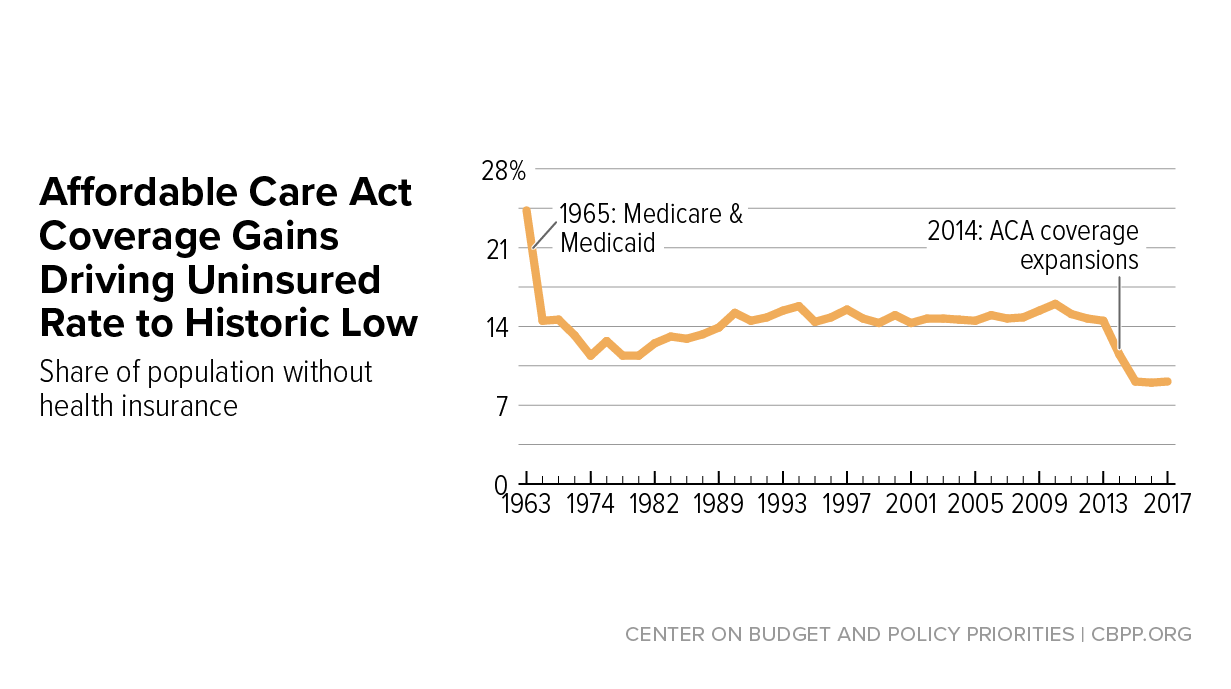

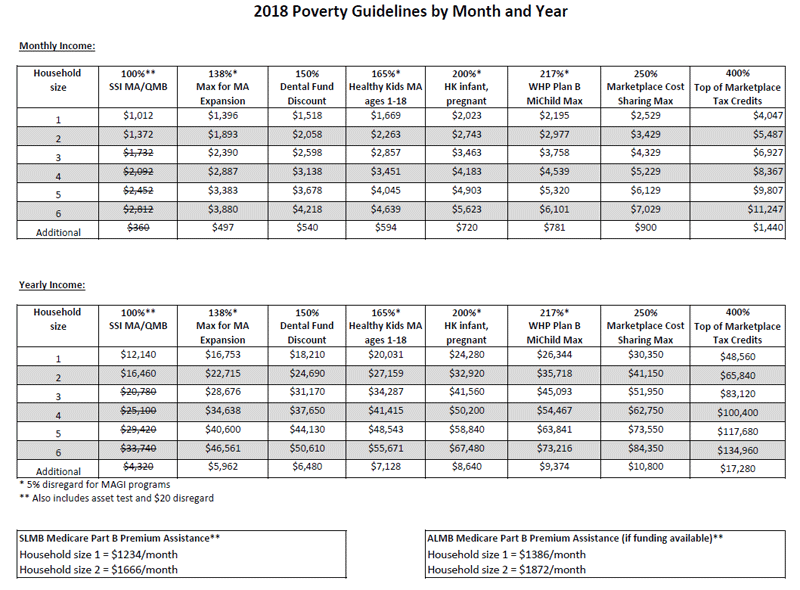

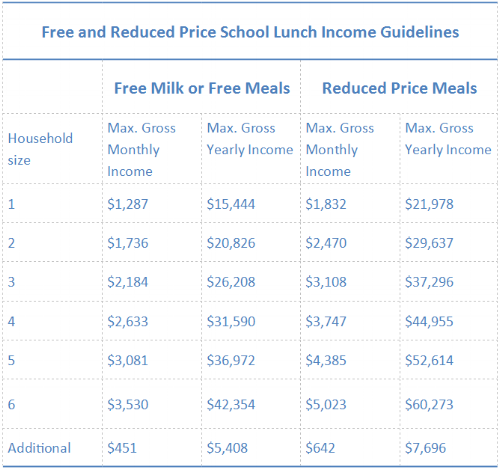

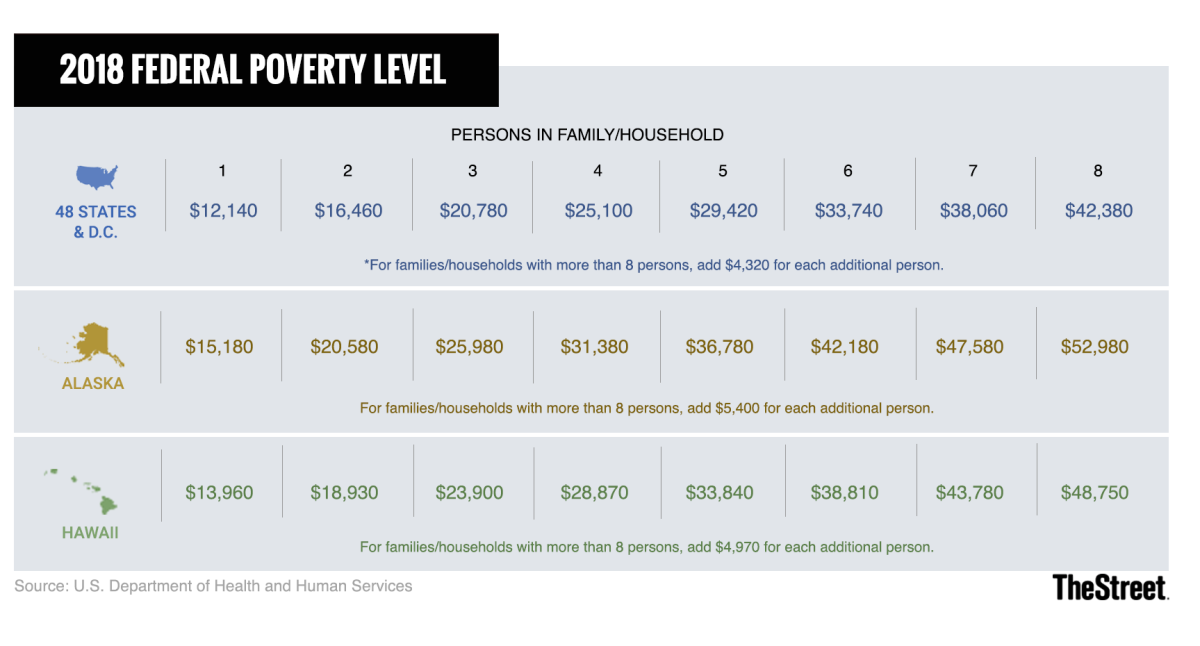

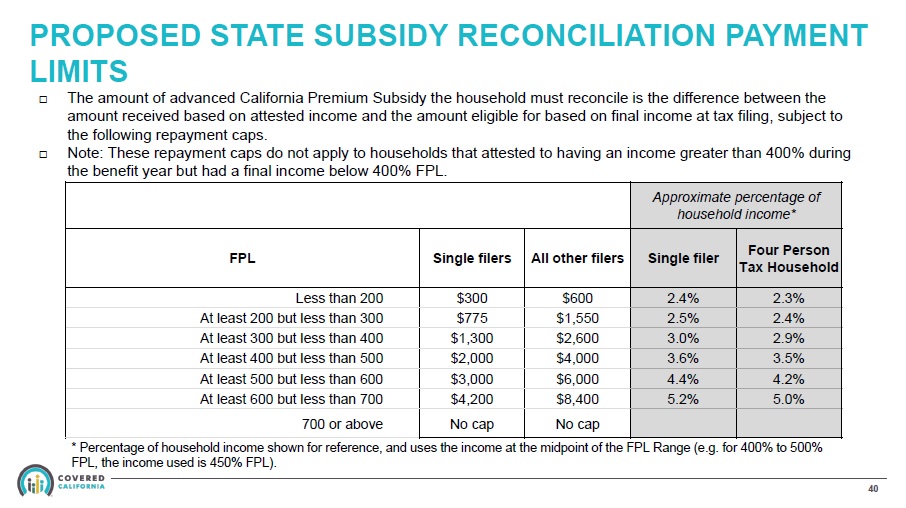

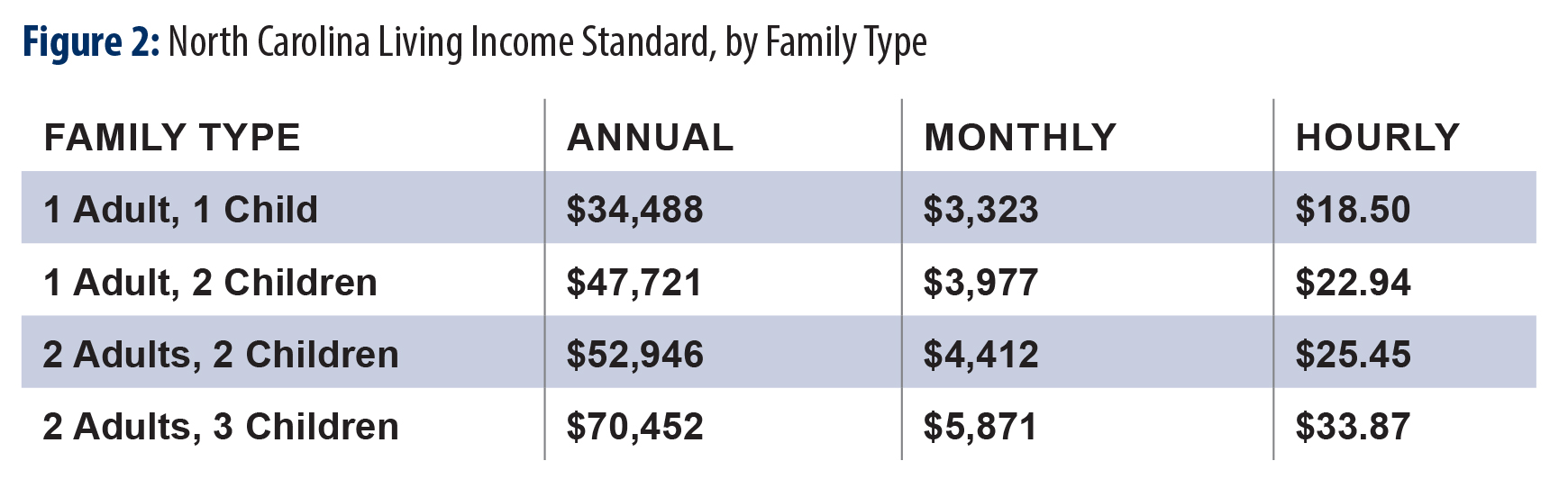

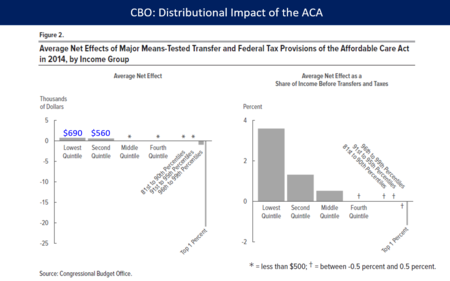

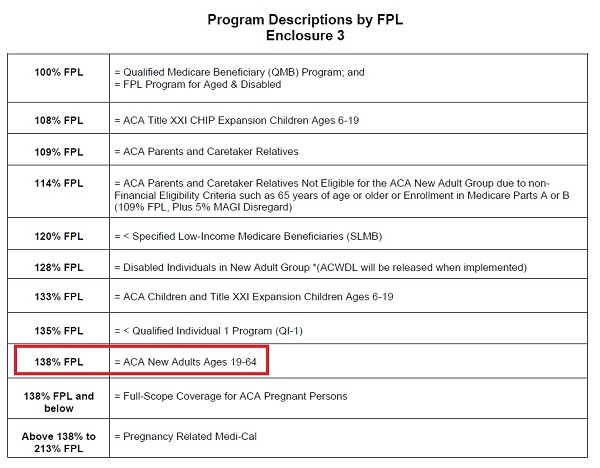

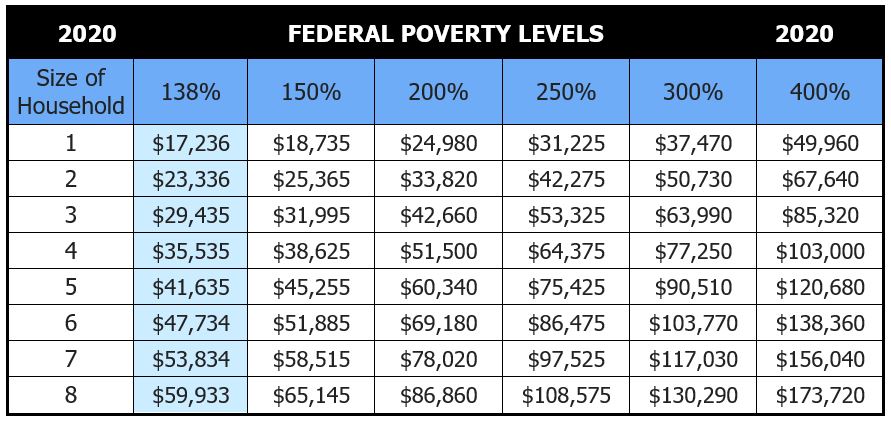

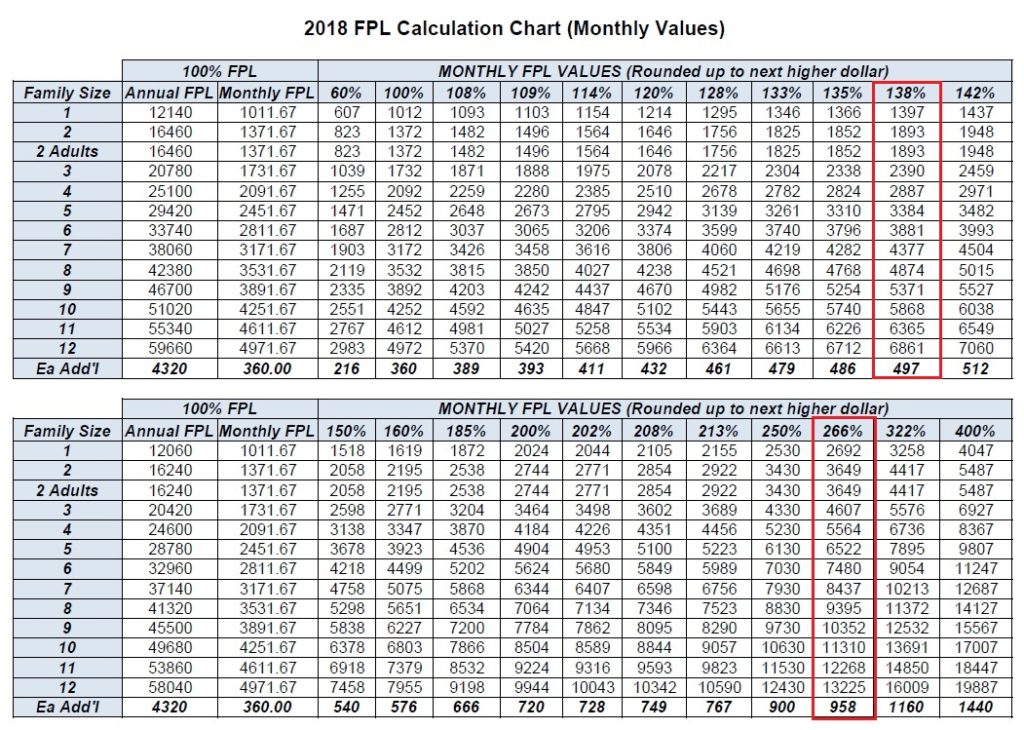

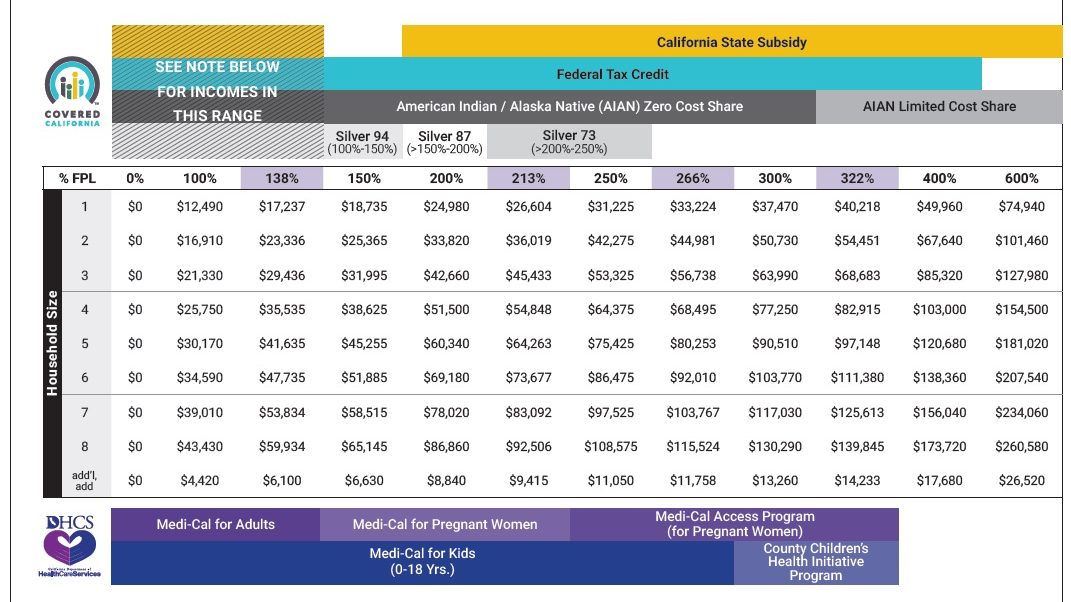

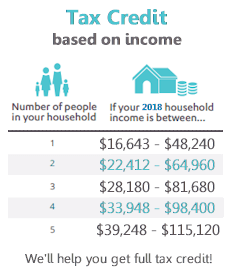

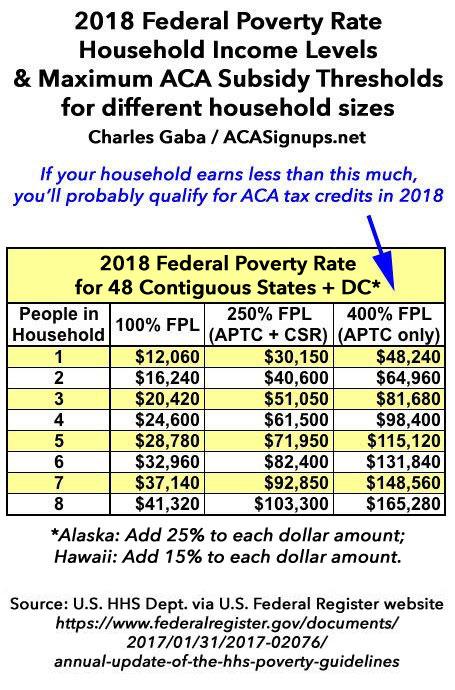

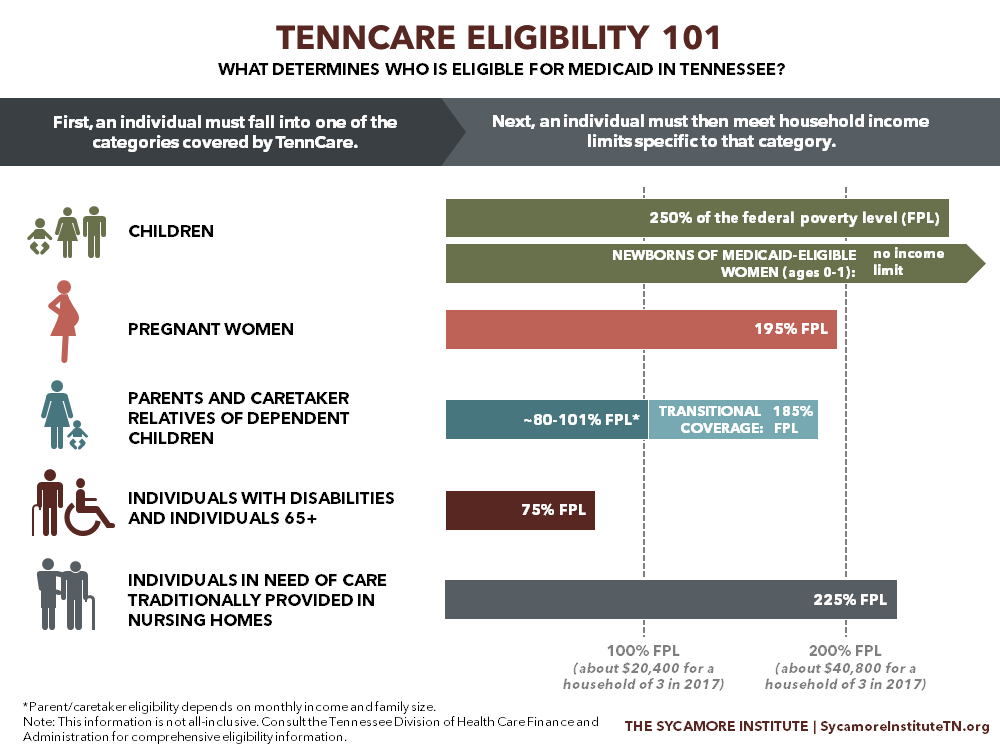

Income under 25 100 to be exact for a family of four two adults two children 20 780 for a family of three and 12 140 for an individual are considered poverty levels in the united states. To get obamacare subsidies your household cannot make more than 400 of the federal poverty level. If your household income falls within these levels you ll qualify for the credit.

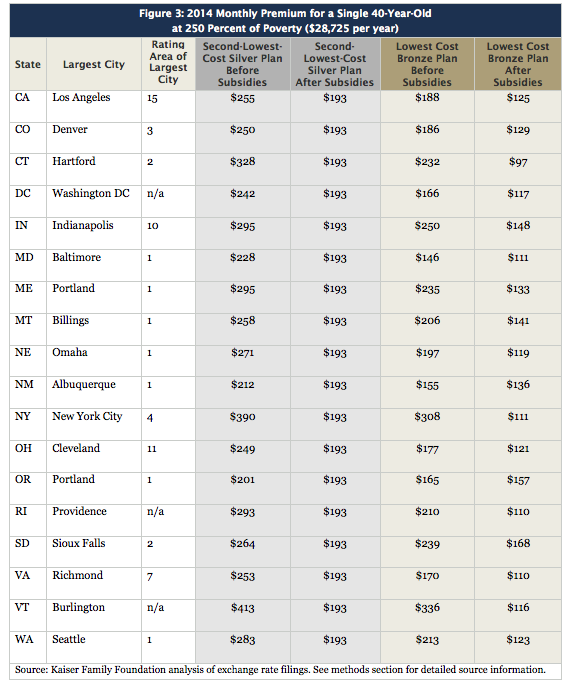

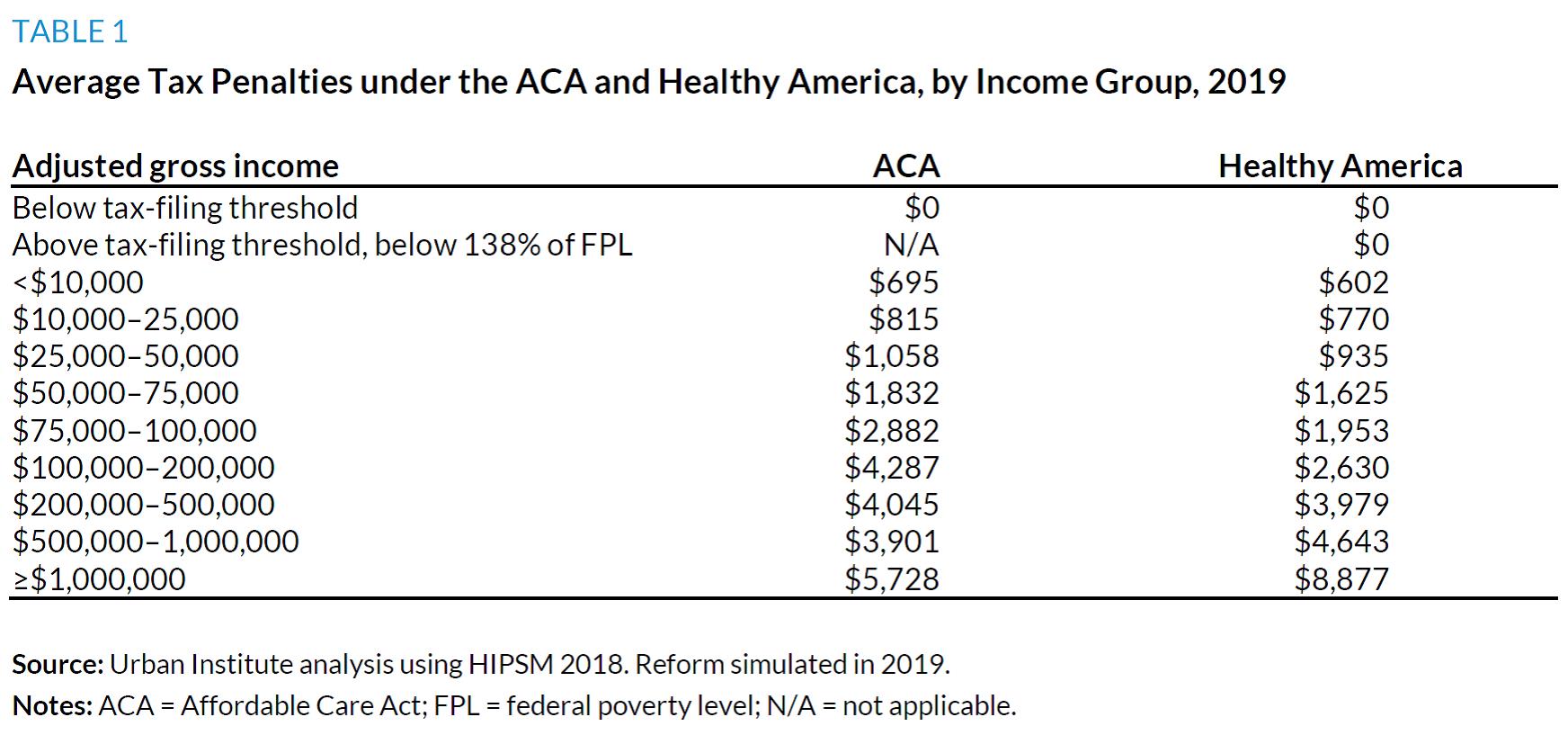

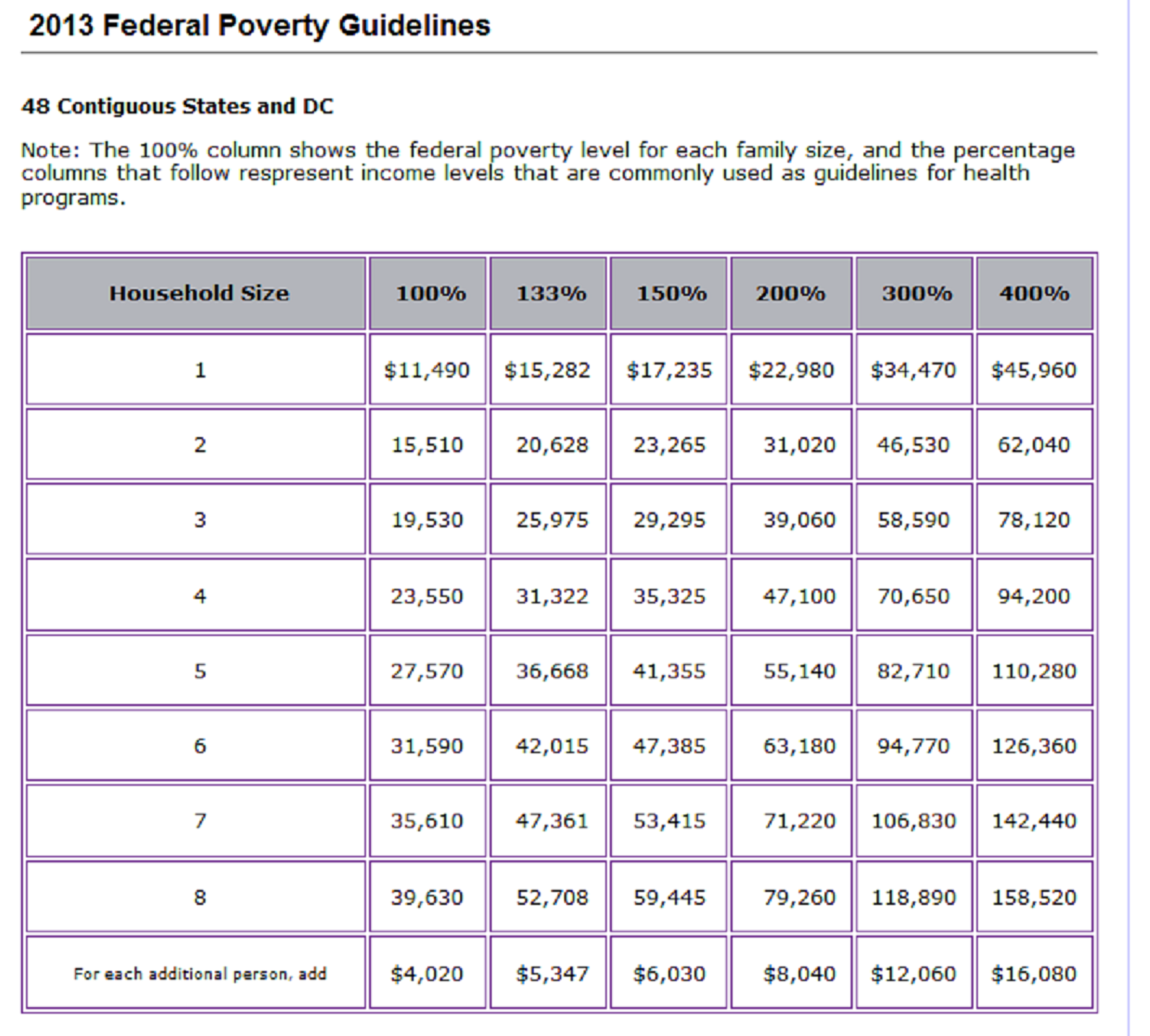

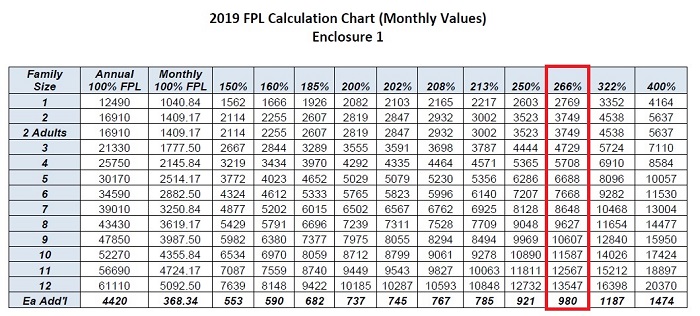

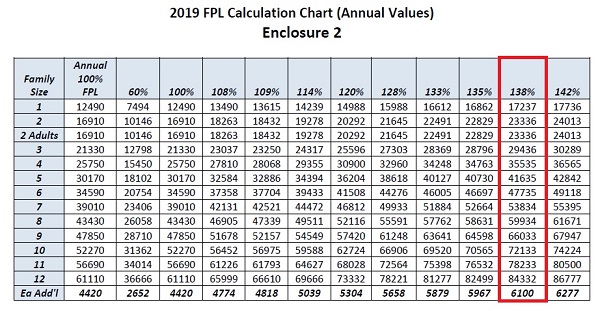

Analysis of income limits for subsidies poverty levels. These are to be used for. Below are the 2018 federal poverty guidelines that went into effect on january 13 2018.

2019 marketplace cost assistance on all marketplace health plans held in 2019 and purchased during open enrollment for 2019 which starts in 2018 and which is why it uses the 2018 levels. It shows the maximum income that households of various sizes can earn which is no more than four times the 2018 federal poverty level the qualifying limit for the credit.

.jpg)

.jpg)